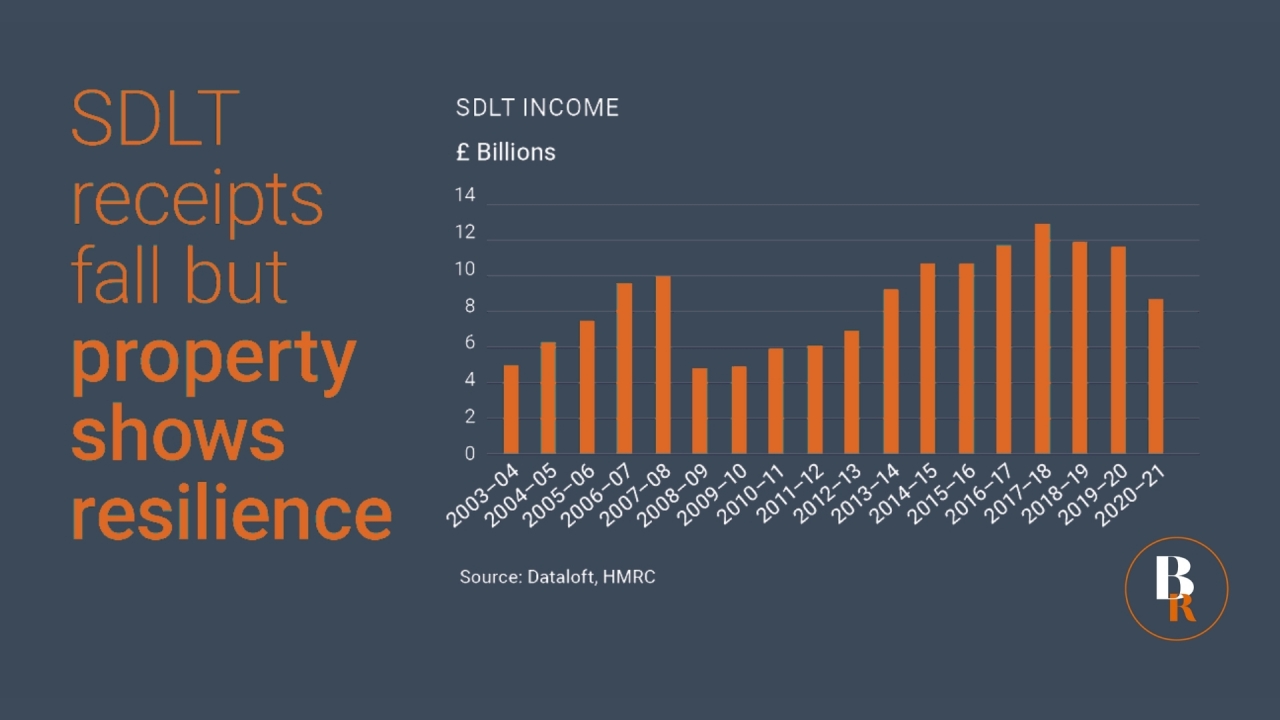

£8.7 billion was netted by the Chancellor in residential Stamp Duty receipts over the course of 2020–21, the lowest in eight years, however receipts in March 2021 were the 5th highest ever recorded.

Nearly £1.2 billion was collected in March, up 28% year-on-year, as many sought to complete property purchases prior to the original Stamp Duty Holiday deadline.

Total SDLT receipts in the year to March were £2.9 billion (25%) lower year-on-year, the enforced closure of the market and the subsequent raising of the 0% threshold to £500k significant factors.

Despite residential tax receipts falling, the property market has proved, along with education, to be the most Covid-resilient according to data released by the ONS.

There could still be a partial saving to be had if your property purchase price is less than £250,000 and completes by the 30th of September. Realistically a sale needs to have been agreed by the 7th of June 2021.

SDLT rates from 1st July to 30th September

| TAX BAND | NORMAL RATE | ADDITIONAL PROPERTY |

|---|---|---|

| less than 250k | 0% | 3%* |

| 250k to 925k | 5% | 8% |

| 925k to 1.5m | 10% | 13% |

| over 1.5m | 12% | 15% |

* An additional property purchased for less than £40k will attract 0% tax. For purchases from £40k to £250k the SDLT rate will be 3% on full purchase price.

If you are looking to sell a property and make a partial saving on stamp duty, now is the time to do so. Book a valuation today https://butlerresidential.co.uk/value-my-property

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link