Did you watch the pennies last year?

Lockdown certainly curbed a lot of people's spending habits, enabling a lot of first-time buyers to save thousands of pounds.

First-time buyer purchases fell by -13% in 2020, the result of a closed housing market in spring and stricter mortgage lending.

First-time buyer transactions recovered in the second half of the year, down just -2% on the same period in 2019.

The average price paid by a UK first-time buyer in 2020 was £256,057, a 10% annual increase.

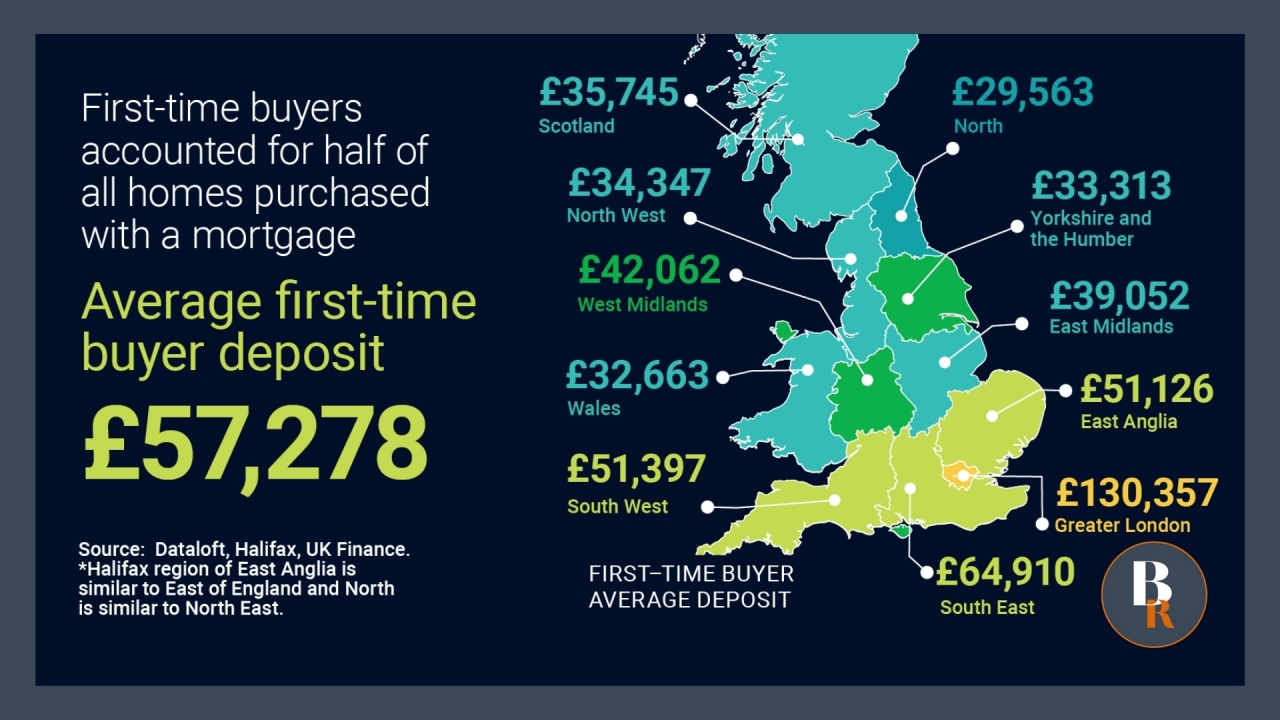

Deposits also increased, the average first-time buyer deposit in 2020 was £57,278, a 23% annual increase.

Despite the need to raise an even bigger deposit, first-time buyers accounted for half of all homes purchased with a mortgage, in line with 2019 (51%) and 2018 (50%)

Are you a first time buyer looking for some mortgage advice? Then contact Nikki or Sophie at Finesse Mortgage Services https://www.finessemortgageservices.co.uk/contact-page/

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link